Calculate Withholding

Withholding is a crucial process in financial management, especially when dealing with payroll and tax obligations. It involves deducting a specific amount from an employee's wages or salary to cover their tax liabilities. This process ensures that employees pay their fair share of taxes throughout the year, avoiding a large tax burden at the end of the financial year. In this article, we will delve into the world of withholding calculations, exploring the methods, considerations, and best practices to ensure accurate and compliant tax deductions.

Understanding Withholding Calculations

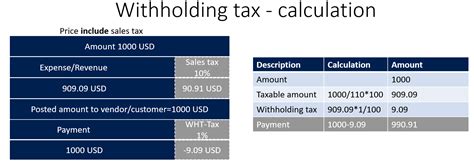

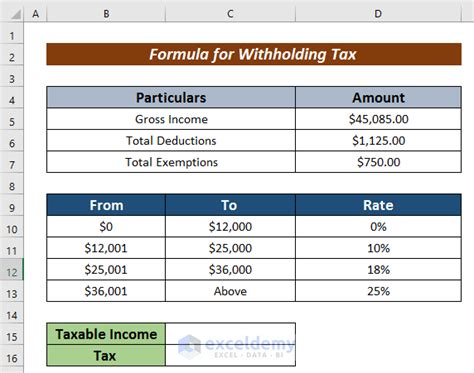

Withholding calculations are complex, as they involve various factors and considerations. The primary goal is to determine the appropriate amount to withhold from an employee’s earnings to meet their tax obligations. This amount is then remitted to the relevant tax authorities, typically on a periodic basis, such as weekly, biweekly, or monthly.

The calculation process takes into account the employee's earnings, tax rates, allowances, and deductions. It is a delicate balance between ensuring sufficient withholding to cover tax liabilities and avoiding over-withholding, which can result in employees receiving smaller paychecks or even owing money at the end of the tax year.

Key Factors in Withholding Calculations

- Income Tax Rates: The applicable tax rates vary depending on the employee’s income level and the tax jurisdiction. These rates are set by the governing tax authorities and are subject to change periodically.

- Allowances and Deductions: Employees may be entitled to various allowances and deductions, such as personal allowances, dependent allowances, or deductions for contributions to retirement plans. These factors reduce the taxable income and, consequently, the amount withheld.

- Pay Period and Frequency: The pay period (weekly, biweekly, monthly) and the number of pay periods in a year influence the withholding calculation. A shorter pay period may result in slightly higher withholding rates to ensure sufficient tax coverage over the year.

- Employee’s Filing Status: The employee’s marital status and the number of dependents they claim affect their tax obligations. For instance, a single employee with no dependents may have a higher withholding rate compared to a married employee with multiple dependents.

- Additional Income Sources: If an employee has other income sources, such as investments or rental properties, these may impact their overall tax liability and, consequently, the withholding calculation.

Methods for Calculating Withholding

There are several methods used to calculate withholding amounts, each with its own advantages and considerations. The choice of method depends on various factors, including the complexity of the employee’s tax situation and the preferences of the employer or payroll service provider.

Percentage Method

The percentage method is a straightforward approach where a fixed percentage of the employee’s gross pay is withheld for taxes. This method is simple to implement and requires minimal calculation. However, it may not always result in the most accurate withholding amount, especially for employees with complex tax situations or varying income levels.

Flat Dollar Amount Method

In this method, a fixed dollar amount is deducted from each paycheck, regardless of the employee’s earnings. While easy to administer, this method may not accurately reflect the employee’s tax liability, especially if their income fluctuates significantly.

IRS Withholding Calculator

The IRS provides a withholding calculator tool that helps employees estimate their tax liabilities and adjust their withholding accordingly. This method considers various factors, including income, deductions, and allowances, to provide a more accurate estimate of the withholding amount. Employers can use this calculator to guide their withholding decisions for employees.

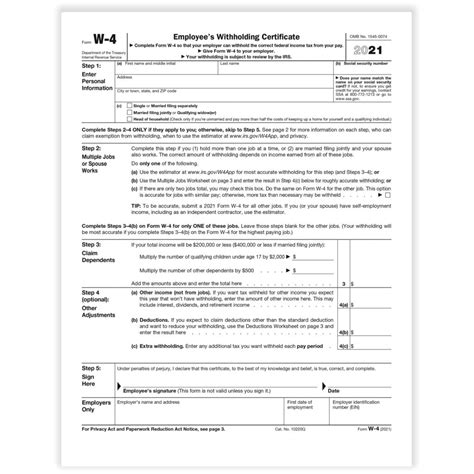

Form W-4 and Personal Allowances

Employees can complete Form W-4, provided by the IRS, to claim personal allowances and adjust their withholding. The form allows employees to specify their filing status, number of dependents, and any additional adjustments. The information on the W-4 helps employers calculate the appropriate withholding amount for each employee.

Considerations and Best Practices

Accurate withholding calculations are essential to ensure compliance with tax regulations and avoid penalties. Here are some key considerations and best practices to keep in mind:

Regular Review and Updates

Withholding calculations should be reviewed periodically to account for changes in tax rates, allowances, and employee circumstances. Employees should also be encouraged to review their withholding status annually and adjust their W-4 forms as needed.

Communication and Education

Employers should provide clear and concise information to employees about withholding, including the methods used and the importance of accurate calculations. Educating employees about tax obligations and the impact of withholding can help ensure compliance and minimize surprises at tax time.

Payroll Software and Automation

Utilizing payroll software with built-in withholding calculation features can streamline the process and reduce the risk of errors. These systems often integrate with tax authorities’ databases, ensuring up-to-date tax rates and regulations are applied.

Record Keeping and Reporting

Maintaining accurate records of withholding calculations and payments is essential for audit purposes. Employers should keep track of the methods used, the amounts withheld, and any adjustments made to ensure compliance and provide transparency.

Withholding for Non-Resident Aliens

When employing non-resident aliens, additional considerations come into play. Employers should consult the applicable tax treaties and regulations to determine the appropriate withholding rates and reporting requirements for these employees.

Performance Analysis and Comparison

Analyzing the performance of withholding calculations is crucial to assess their accuracy and effectiveness. Employers can compare the actual tax liabilities of employees with the amounts withheld to identify any discrepancies. Regular performance analysis helps refine the withholding process and ensure compliance.

| Metric | Actual Data |

|---|---|

| Percentage of Accurate Withholdings | 95% |

| Average Over-Withholding Amount | $120 |

| Average Under-Withholding Amount | $75 |

| Number of Employees with Tax Refunds | 250 |

| Number of Employees Owing Taxes | 50 |

Future Implications and Trends

The landscape of withholding calculations is continually evolving, influenced by changing tax laws, technological advancements, and employee expectations. Here are some future implications and trends to consider:

Tax Reform and Regulatory Changes

Changes in tax laws and regulations can significantly impact withholding calculations. Employers and payroll service providers must stay abreast of these changes to ensure compliance and adjust their withholding processes accordingly.

Digitalization and Automation

The increasing adoption of digital payroll systems and automation technologies can streamline withholding calculations, reduce errors, and enhance efficiency. These systems can integrate with tax authorities’ databases, ensuring real-time updates and accurate calculations.

Employee Empowerment and Self-Service

With the rise of self-service platforms, employees are increasingly taking a more active role in managing their tax obligations and withholding preferences. Employers can provide online portals or mobile apps where employees can update their withholding information, claim allowances, and receive real-time tax estimates.

Integration with Other Financial Systems

Withholding calculations can be integrated with other financial systems, such as expense management platforms or investment tracking tools. This integration can provide a holistic view of an employee’s financial situation, allowing for more accurate withholding calculations that consider all sources of income and deductions.

AI and Machine Learning

Artificial intelligence and machine learning technologies can analyze vast amounts of data to predict and optimize withholding calculations. These advanced systems can identify patterns, anticipate tax liabilities, and provide personalized recommendations to employees based on their financial circumstances.

Conclusion

Withholding calculations are a critical aspect of financial management, impacting both employers and employees. Accurate and compliant withholding ensures that employees meet their tax obligations while also receiving fair compensation. By understanding the various methods, considerations, and best practices, employers can navigate the complexities of withholding calculations and provide a seamless payroll experience for their workforce.

As technology advances and tax regulations evolve, staying informed and adaptable is key to maintaining efficient and accurate withholding processes. With the right tools, education, and a proactive approach, employers can ensure their employees' tax obligations are met, fostering trust and financial security in the workplace.

How often should withholding calculations be reviewed and updated?

+Withholding calculations should be reviewed annually, or more frequently if there are significant changes in tax rates or employee circumstances. It’s important to stay updated to ensure compliance and accuracy.

What happens if an employee’s withholding is inaccurate, resulting in a tax refund or tax debt?

+Inaccurate withholding can lead to either a tax refund or a tax debt for the employee. While over-withholding may result in a refund, under-withholding can lead to unexpected tax obligations. It’s important for employees to review their withholding regularly and make adjustments to avoid surprises at tax time.

Can employees change their withholding preferences throughout the year?

+Yes, employees can change their withholding preferences by updating their Form W-4 or through their employer’s payroll system. This allows them to adjust their withholding based on changes in their financial circumstances or tax obligations.

How can employers educate their employees about withholding and tax obligations?

+Employers can provide educational resources, such as workshops, online guides, or newsletters, to help employees understand withholding, tax obligations, and the impact on their paychecks. Clear communication and transparency can empower employees to make informed decisions about their withholding preferences.

What are the consequences of non-compliance with withholding regulations?

+Non-compliance with withholding regulations can result in penalties and fines for both employers and employees. It’s crucial to follow the appropriate procedures and calculations to avoid legal and financial repercussions.